Going Concern Concept What Is It, Examples, Assumptions

IAS 1 states that management may need to consider a wide range of factors, including current and forecasted profitability, debt maturities and replacement financing options before satisfying its going concern assessment. Management assesses all available information about the future for at least, but not limited to, 12 months from the reporting date. This means the 12-month period is a minimum and management needs to exercise judgment to determine the appropriate look-forward period under the circumstances. Factors to consider include when the financial statements are authorized for issuance and whether there is any known event occurring after the minimum period of 12 months from the reporting date relevant to the analysis. Accounting standards try to determine what a company should disclose on its financial statements if there are doubts about its ability to continue as a going concern. In May 2014, the Financial Accounting Standards Board determined financial statements should reveal the conditions that support an entity’s substantial doubt that it can continue as a going concern.

Going Concern Auditing Summary

The liquidation value of a company will even be lower than the value of the company’s tangible assets, because the company may have to sell off its tangible assets at a discount—often, a deep discount—in order to liquidate them before ceasing operations. Examples of tangible assets that might be sold at a loss include equipment, unsold inventory, real estate, vehicles, patents, and other intellectual property (IP), furniture, and fixtures. Business risks include risks that could reduce the company’s profit and/or cash inflows, and could ultimately mean that either a company is not a going concern, or that there are significant doubts over its ability to continue as a going concern.

Impact of external events on the going concern assessment and disclosures

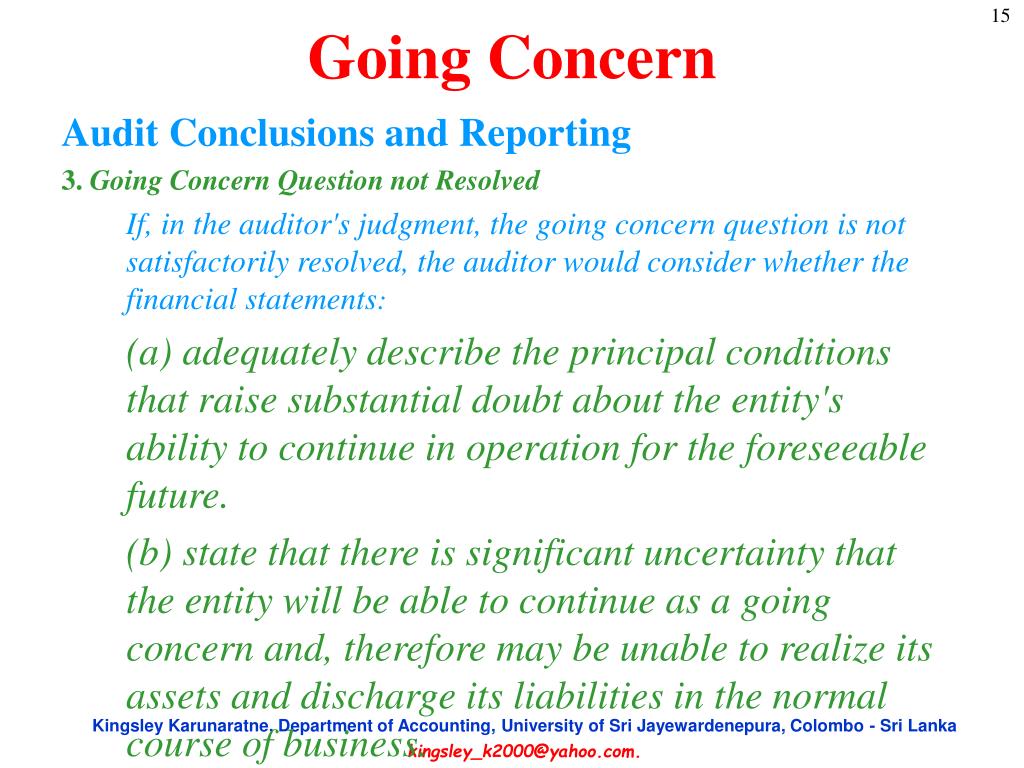

When assessing a company’s ability to continue as a going concern, management may need to do the following. Before an auditor issues a going concern qualification, company leadership will be given an opportunity to create a plan to take corrective actions that can improve the outlook for the business. If the auditor determines the plan can be executed and mitigates concerns about the business, 2013 federal irs tax calculators and tax forms file now then a qualified opinion will not be issued. A financial auditor is hired by a business to evaluate whether its assessment of going concern is accurate. After conducting a thorough review (audit) of the business’s financials, the auditor will provide a report with their assessment. Management’s plans should be considered only if is it probable that they will be effectively implemented.

- If substantial doubt does not exist, then going concern disclosures are not necessary.

- Management typically develops plans to address going concern uncertainties – e.g. refinancing of debt, renegotiating breached covenants, and sale of assets to generate sufficient liquidity to continue to meet its obligations as they fall due.

- Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching.

- However, financial figures are the results of how the company is affected by non-financial figures, especially the environment.

Subscribe to the IFRS® Perspectives Newsletter

Going concern is an accounting term used to identify whether a company is likely to survive the next year. Companies that are not a going concern may not have enough money to survive, and this fact must be publicly disclosed when an auditor audits their financial statements. A company may not be a going concern for a number of reasons, and management must disclose the reason why. Economic uncertainty has been prevalent in global markets over the last several years due to many unexpected macro events – from COVID-19 and the related supply chain disruptions to international conflicts and rising interest rates. While some companies thrive from uncertainty, others may see their financial performance, liquidity and cash flow projections negatively impacted. These vulnerabilities continue to shine a bright light on management’s responsibility for a going concern assessment.

Guide to Going Concern Assessments

Some or all of the services described herein may not be permissible for KPMG audit clients and their affiliates or related entities.The information contained herein is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act upon such information without appropriate professional advice after a thorough examination of the particular situation. In evaluating going concern, the auditor will consider whether necessary borrowing facilities are in place and in doing so will attempt to obtain confirmations from the company’s bankers.

Unless it is known that the business will close down at a future time, all transactions are recorded in a routine manner and there is no need for any special valuation or adjustment. © 2024 KPMG LLP, a Delaware limited liability partnership and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. Helping clients meet their business challenges begins with an in-depth understanding of the industries in which they work. In fact, KPMG LLP was the first of the Big Four firms to organize itself along the same industry lines as clients. However, liquidating a company means laying off all of its employees, and if the company is viable, this can have negative ramifications not only for the laid-off workers but also for the investor who made the decision to liquidate a healthy company.

Disclosures of material uncertainties that may cast doubt on a company’s ability to continue as a going concern as well as significant judgments involved in close-call scenarios may be more frequent as a result of COVID-19, given the continued economic uncertainty. Management should critically assess the disclosure requirements of IAS 1 and consider drafting required disclosure language early in the financial reporting process. So, should an auditor inquire about conditions and events that may affect the entity’s ability to continue as a going concern beyond management’s period of evaluation (i.e., one year from the date the financial statements are available to be issued or issued, as applicable)? Because the US GAAP guidance is more developed in this area, it may provide certain useful reference points for IFRS Standards preparers – e.g. to identify adverse conditions and events or to assess the mitigating effects of management’s plans. However, dual reporters should be mindful of the differing frameworks, terminologies and potentially different outcomes in their going concern conclusions. Our IFRS Standards resources will help you to better understand the potential accounting and disclosure implications of COVID-19 for your company, and the actions management can take now.

Also, it must be probable that management’s plans will be effective in alleviating substantial doubt. An entity is assumed to be a going concern in the absence of significant information to the contrary. An example of such contrary information is an entity’s inability to meet its obligations as they come due without substantial asset sales or debt restructurings.

There are often certain accounting measures that must be taken to write down the value of the company on the business’s financial reports. A company may not be a going concern based on the financial position on either its income statement or balance sheet. For example, a company’s annual expenses may so vastly outweigh its revenue that it can’t reasonably make a profit.

Given these circumstances, if Chemical X is the only product the company produces, the business will no longer be classified as a going concern. This is because it would make it impossible for the business to carry out its present contractual commitments or to use its resources according to a predetermined plan of operation. However, if it is known that a business will close down in, for example, the next two or three months, it would be more appropriate to state its assets not at cost but at the value at which these can be sold on the closure of the business.